30+ Simple amortization calculator

Auto Loan Amortization Calculator. Mortgage Calculator exe file - click the link and immediately run the mortgage calculator.

Best 10 Mortgage Calculator Apps Last Updated September 16 2022

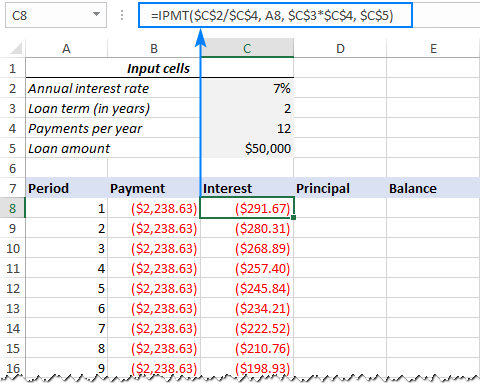

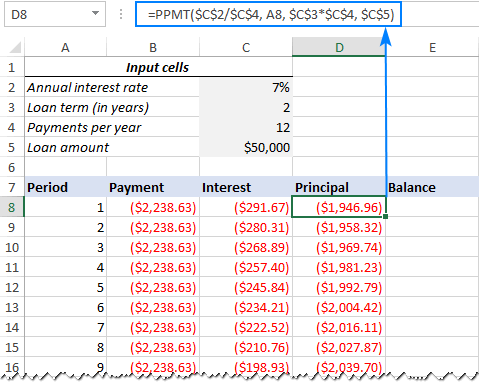

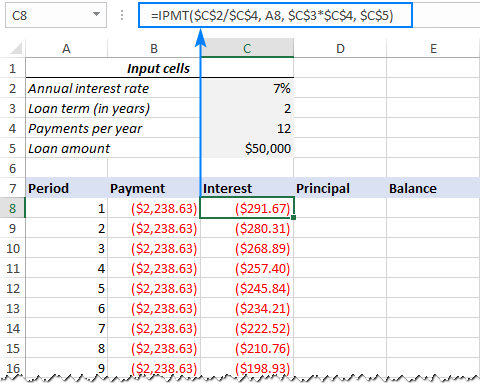

Using the above formulas in excel he gets amortization schedule.

. At the end of. Mortgage Amount Interest Rate. Our loan calculator will help you generate monthly and yearly amortiztion schedules for any proposed loan.

Calculate loan payment payoff time balloon interest rate even negative amortizations. Calculate interest only and amortizing mortgage payments on the same amortization schedule as well as balloon payments. This is the best option if you are in a rush andor only plan on using the calculator today.

See how those payments break down over your loan term with our amortization calculator. Rates locked in for duration of loan. In this case you will calculate monthly amortization.

Principal paid and your loan balance over the life of your loan. If the nominal annual interest rate is i 75 and the interest is compounded semi-annually n 2 and payments are made monthly p 12 then the rate per period will be r 06155. Almost any data field on this form may be calculated.

The amortization schedules summary header clearly shows you the amount of interest you will save by making extra payments. Find your monthly payment total interest and final pay-off date. Your last loan payment will pay off the final amount remaining on your debt.

This is the best option if you plan on using the calculator many times over the. USDA Loan Mortgage Calculator Simple Mortgage Calculator PITI. However interest rates for ARMs change at regular intervals so both the total monthly payment due and the mix of principal and interest in a given payment can change considerably at each interest-rate reset.

It also refers to the spreading out. Repeat the same till last month and we will get amortization schedule. Our amortization schedule calculator will show your payment breakdown of interest vs.

Youll need the principal amount and the interest rate. The principal is the current loan amount. These are also the basic components of a mortgage.

Extra payments are not extra. Simple Interest Loan Amortization Calculator is an online personal finance assessment tool which allows loan borrower to find out the best loan in the finance market. In the US the most common mortgage loan is the conventional 30-year fixed-interest loan which represents 70 to 90 of all mortgages.

Since borrowers only pay interest in the interest-only period the HELOC amortization schedule for that period will be just for interest payments and 0 for the principal. Export to printable PDF andor Excel files. For example a 30-year fixed mortgage would have 360 payments 30x12360.

A mortgage usually includes the following key components. The HELOC payment calculator generates a HELOC amortization schedule that breaks down each monthly payment with interest and the principal amount that a borrower will be paying. Simple Mortgage Payment Calculator.

The Mortgage Payment Calculator allows you to calculate monthly payments average monthly interest total interest and total payment. For example say you are paying off a 30-year mortgage. Use this car loan calculator to estimate your monthly payments and check amortization schedule also see how factors like trade-in value and sales tax affect payments.

30 145823 4481 888302 31 146455 3849 741848 32 147089 3215 594758. We also provide the ability to create an inline amortization table below the calculator or a printer friendly amortization table in a new window. Rent versus Buy Calculator.

Mortgage Calculator zip file - download the zip file extract it and install it on your computer. By making additional monthly payments you will be able to repay your loan much more quickly. The amortization summary and interest saved.

However for those who can afford the slightly higher payment associated with a 15-year mortgage are getting a better deal in almost every possible way. A note on terminology. Brets mortgageloan amortization schedule calculator.

For example after exactly 30 years or 360 monthly payments youll pay off a 30-year mortgage. Amortization tables help you understand how a loan works and they can help you predict your outstanding balance or interest cost at any point in the future. If the compound period is shorter than the payment period using this formula results in negative amortization paying interest on interest.

Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel xlsx xls or pdf format. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage. See how your loan balance decreases fastest.

Mortgages are how most people are able to own homes in the US. To calculate amortization you also need the term of the loan and the payment amount each period. A person has taken the auto loan of 200000 with the rate of interest 9 for the tenure of 3 years and he wants to prepare his amortization schedule.

Calculator allows for 30360 actual360 and actual365 interest methods. Now we will see an example to prepare amortization schedule. Enter the appropriate numbers in each slot leaving blank or zero the value that you wish to determine and then.

The big advantage of a 30-year home loan over a 15-year loan is a lower monthly payment. Amortization schedule showing 100 extra payments. View annually or monthly.

Loan Amount Interest Rate Term. Amortization summary showing over 22000 in interest savings. For Adjustable Rate Mortgages ARMs amortization works the same as the loans total term usually 30 years is known at the outset.

Amortization is the paying off of debt with a fixed repayment schedule in regular installments over a period of time for example with a mortgage or a car loan. In addition to this simple loan payment calculator we also offer tools for helping you determine your monthly mortgage auto and debt consolidation payments. A bank will find it much easier to finance an auto loan if youre coming with 20-30 down than if you want 100 of the cars purchase.

The calculator lets you determine monthly mortgage payments find out how your monthly yearly or one-time pre-payments influence the loan term and the interest paid over the life of the loan and see complete amortization schedules. Simple interest rate and maturity period are the key terms to generate the amortization schedule. Prepayment After Month Full Amortization Table.

This calculator allows you to calculate monthly payment average monthly interest total interest and total payment of your mortgage.

Loanplus Loan Credit Company Html Template Credit Companies Credit Card Debt Settlement Loan

30 Questionnaire Templates And Designs In Microsoft Word Inside Business Requirements Questionnaire Tem Questionnaire Template Questionnaire Business Template

Borrow Loan Company Responsive Website Templates Loan Company Wordpress Theme Responsive The Borrowers

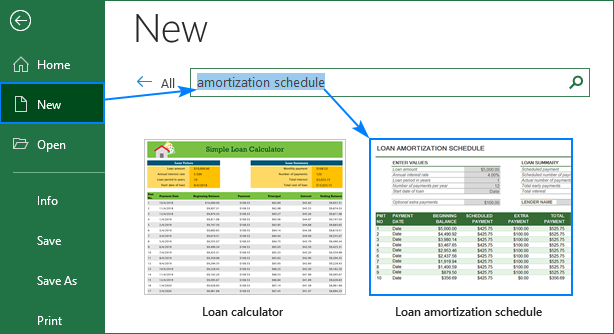

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Best 10 Mortgage Calculator Apps Last Updated September 16 2022

2 Must Have Weekly Sales Report Templates Free Download Pertaining To Sales Management Report Progress Report Template Report Template Contents Page Template

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Athene Holding Ltd Current Report 8 K

2

![]()

Best 10 Mortgage Calculator Apps Last Updated September 16 2022

Ex 99 1

![]()

Best 10 Mortgage Calculator Apps Last Updated September 16 2022

2